FX Primaries Prepare to Fight Back in 2022 – Will It Work?

Posted by Colin Lambert. Last updated: January 12, 2022

Much has been made of the decline in volumes at both Refinitiv’s Matching and EBS Market over the past few years as internalisation and a lack of FX volatility generally has had an increasingly sizeable impact. There is a paradox, however, in that the market data generated by these platforms remains of the highest importance to so many participants in the FX market – the top group of players may be able to generate enough data from their internalisation programmes, but for the majority of players, the primary CLOBs remain the lifeblood of their e-pricing systems.

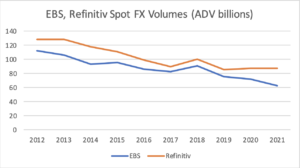

The high-level numbers released by both venues each month suggest a picture of steady, decline, however this data hides the real, and more troubling, story. As the chart below indicates, volumes have almost halved on EBS and are down 31.7% at Refinitiv over the past 10 years, but that data includes volumes from all venues at the firms concerned, for example EBS Direct has been launched in that period and at Refinitiv FXall volumes have reportedly been steady over that period. In terms of the two primary venues, the decline is more likely to be something more dramatic, with EBS declining from above $100 billion per day in 2012 to around $30 billion thus far in 2021; and Matching declining from around the $60-70 billion per day mark to $30 billion.

As the FX industry eyes 2022, however, moves are being made at both Refinitiv and EBS, aimed at halting the decline and, the firms hope, reversing it. Both are seeking to incentivise natural interest and “good” market making behaviour. They are going at the issue in slightly different fashions, but both have the perceived, or actual, trading environment very much in mind with their proposed changes.

Underpinning both efforts is a re-platforming, with EBS expected to complete its migration to owner CME’s Globex infrastructure in March, and Refinitiv, which came under new ownership more recently, targeting the start of 2023 as the completion date for its own re-platforming at LSE Group.

It is fair to say that the majority of the FX industry thinks re-platforming Matching is a good idea, for while there have been changes, and market data rates have improved in recent years, it has failed to keep pace with the broader technological leap forward in FX markets. The re-platforming is expected to bring, the firm says, a “generation jump in performance” including further latency reduction and the introduction of order types that the modern FX market expects, and knows how to use. The shift is also expected to make the platform more accessible to GUI users, often seen as a key metric for market quality on a CLOB.

There also seems to be an air of optimism in senior circles at EBS about the planned migration and the benefits it will bring. Sources at the firm expect the change to Globex to reinforce measures already in place aimed at a greater concentration of liquidity in single matching engines, greater determinism and more efficient connectivity through a common API. EBS is introducing two new market support programmes alongside the migration, aimed at maintaining a consistent spread and mid-point, as well as encouraging improved behaviours.

Carrots…and Sticks

One of the challenges facing the two firms is actually defining “good” behaviour on their venues, with so many different trading interests making up the market, what is a profitable strategy to one firm is anathema to another. What is significant about the proposed changes at both firms is that they are guaranteed almost to upset somebody. This may be no bad thing, however, for it could be argued that trying to keep all parties happy has rather stymied previous attempts to stem the decline in volumes.

Interestingly, the changes at Refinitiv partly stemmed from discussions about the re-platforming, as Geoff Jones, director of spot venues at the firm, explains. “Resulting from discussions around the re-platforming, it became apparent that there is an opportunity for a new paradigm for Matching, specifically changing the criteria by which users can consume high frequency data. Feedback was that a lot of firms receive the value of, and are getting the benefit of, faster market data but don’t participate in the reference pricing they value so highly. It’s probably the biggest complaint we hear from our bank and non-bank market makers, firms having access to the data that don’t contribute to it.”

There is an opportunity for a new paradigm for Matching, specifically changing the criteria by which users can consume high frequency data

At the heart of the Refinitiv changes is that market data, specifically, the firm’s binary market data feed at 5ms is becoming participant-eligible, as revealed by The Full FX earlier this month. The threshold for the participation is $2 billion in spot volume a month on Matching, of which 25% is as a “maker”.

The threshold has been set at what might seem quite a low level deliberately, Refinitiv very much sees the changes as evolutionary – as is the case with EBS and its quote-fill ratio proposal – however, the thresholds are very likely to be increased in the future.

The Refinitiv binary feed is also being split, with one for G7 and the other for Scandies and emerging market pairs. “Over time we anticipate changing the criteria further to focus on a participant’s activity, they will need to meet the criteria in an individual feed to benefit from the high frequency data,” says Jones.

There are those who feel that such a programme is bound to fail, as noted in the recent column on this issue, some participants are unhappy and feel that the same approach was tried, without success, by EBS two years ago. Refinitiv’s proposed changes, however, come with a bigger stick. For non-eligible participants, the standard market data feed is being slowed down to 50ms from 25ms.

While such a move could challenge those market makers with regional specialities who fail to hit the volume criteria, the splitting of the binary feed makes qualification more attainable. It may also be felt further down the chain, especially if smaller banks feel that with a slower data feed they can no longer quote certain customers. There are those, several of whom are in the very organisations that may be challenged, who think this is no bad thing and who argue that Refinitiv, while trying to clean up its own trading environment, is likely to force other players to look more closely at their FX business, in particular their client lists. “We’ve been struggling with a small group of larger clients – typically active traders – for years but didn’t want to give up the volume in our core pairs,” explains one senior trader at a regional bank. “If our market data is slowed further the economics will probably force us to do something we possibly should have done years ago, and stop quoting these clients.”

For its part, EBS is tapping into the success of its CNH and NDF franchise, by launching a Messaging Efficiency Programme aimed at encouraging higher quality behaviour at top of book, thus improving the execution experience. The Full FX understands that key to the programme is a reduction in what the firm believes is “excess quoting at top of book”, a practice often referred to as “pipping”, where participants use the data from a resting order to place a bid or offer just inside. This will be achieved by a minimum median order life at top of book or a minimum top of book quote-fill ratio.

EBS has not released the criteria firms are expected to hit, although one market maker claiming knowledge of the plan says it is “reasonable and achievable”, even though it will, in all probability be raised in time. The EBS “stick” is an “excess quoting surcharge” on customers who fall below the required thresholds, this does not, it is understood, come in the form of slower market data, rather it will be financial. As sources at the firm suggest, however, this should not be seen as a revenue source, if EBS is hitting customers with excess quoting bills on a regular basis, then its plan to improve the trading experience is struggling to achieve the desired goals.

A second key plank of the EBS plan is the lowering of the minimum quote lifespan from the current 50ms to 20ms. In isolation this looks like a measure that would undermine attempts to improve market quality, however, as is the case with the Refinitiv changes, as part of a package it should encourage market makers to consider more closely how they interact with the CLOB. More pertinently, market makers could be forced to change their style more towards that of the primary CLOB heyday when market direction was a much bigger part of a firm’s pricing logic.

There is little doubt that it is a brave call by Refinitiv and EBS to impose stricter criteria on their CLOBs, but the sense is it is a call that needed to be made.

The move has been welcomed by one e-FX trading head in Europe who observes, “You will probably find more LPs showing a side under this regime, because they don’t want to change their price too often. The model will shift to one that is more directional in nature, rather than the current ‘broker’ version, where we take flow and turn it. At times top of book spreads may be wider – which is probably not what the platform wants or expects – but the liquidity should be deeper and more robust. They just have to decide what they prefer.”

While the EBS programme very much seeks to punish those firms guilty of excess quoting, Refinitiv has taken a positive commercial approach by introducing an optional “maker programme”. Under the proposal, as long as makers maintain Matching activity above the respective thresholds they are able to access rate card discounts across Refinitiv’s spot platforms.

This means, for example, access to rebates on additional Matching maker volume as well as on PriceStream, where many of Refinitiv’s smaller banks, who rely upon relationship trading, prefer to operate.

To avoid a “cliff-edge” scenario where a firm may have a quieter month, the scheme and binary feed criteria are designed with weighted and average criteria across a three-month rolling window to help makers manage activity levels in such months.

“The goal is to allow a slow evolution of Matching participation,” explains Jones. “Ultimately, as a firm, we want analytical data to drive this evolution. We need data to show us how the schemes are working, so yes while the criteria are something of a blunt instrument, it’s a starting point. We will evolve our criteria, but for now we want people to engage more with the primary market, we have to give them reason to engage, at which point, we can reference how well it’s going. The new technology we are delivering will allow us to judge this better as well, so this is the best solution for the current environment.”

We want to create patterns of trading and liquidity that are appropriate to the needs of our clients and generate the best environment overall for the market.

While commercial incentives are important – one major market maker calculates savings could be “very significant” under the Refinitiv programme – the key to the success or otherwise of both programmes will be the reality, or perception perhaps, that behaviour has improved. “There is no doubt that the market has had trouble digesting the primaries in their current formation, there is a paradox that firms value the data highly, but are using the venues less,” accepts Neill Penney, group head of FX at LSEG. “We need to readapt to remain relevant to the modern market, while retaining all the traditional strengths of the primary market. We want to create patterns of trading and liquidity that are appropriate to the needs of our clients and generate the best environment overall for the market.”

Parallel Lines?

Probably the most significant aspect of this issue is that both primary CLOBs seem to have arrived at the same conclusion, at the same time – a statement has to be made if they are to retain, and possibly rebuild, the value proposition of their headline businesses. As noted, not all participants are going to be happy with the changes, generally the responses to enquiries from The Full FX have been grudging acceptance although several firms are more enthusiastic; there is a small core of firms that are unhappy, however. “This is aimed at keeping two or three firms happy,” argues one source at a proprietary trading firm. “These platforms continue to stress the importance of ‘natural liquidity’ but what does that mean? If you look at larger tickets, they are now executed by algos, and those strategies thrive upon ‘little and often’ when it comes to the execution strategy – why disenfranchise those firms providing liquidity more frequently in smaller amounts?”

It can be argued, of course, in response to this opinion, that if the liquidity being streaming in smaller amounts is of sufficient quality, then the firm concerned would qualify for the respective programmes anyway. As another source at one of the platforms puts it, “This is exactly the type of behaviour that is turning people away, small firms quote-cancelling, making life a nightmare for GUI traders.”

Jones acknowledges the potential for conflict from the move, but is quick to refute any suggestion the changes are aimed at benefiting a small group of players. “Inevitably when schemes like this are launched you risk providing benefits to only a relatively small number of participants,” he acknowledges. “What we are trying to achieve here is to benefit the larger community and create a step change in behaviour across 30 or 40 participants. It’s a risk, but we believe the partnership aspect is the most important. There is a way of taking this platform forward that works for the community as a whole.”

There is little doubt that it is a brave call by Refinitiv and EBS to impose stricter criteria on their CLOBs, but the sense is it is a call that needed to be made. Inertia would only lead to further declines – the pace may have been slower, but the trajectory would have remained downwards.

The fact that the two platforms are taking different approaches to the same problem is probably the result of their respective client bases and core strengths. EBS has to face the challenge of high internalisation rates in its core pairs and sees the way forward very much about increased diversity of client base (closer links with CME FX venues will help) brought about by tighter spreads, decreased market impact and lower negative selection rates.

Refinitiv, on the other hand, already has the diverse client base in both geographical and, more importantly, technological terms, and has to be more careful in how it changes the trading environment. This means it makes more sense to effect the changes via commercial means.

“We are trying to incentivise changes in behaviour through a set of criteria and commercial changes that work in tandem, but our designs need to be digestible by our clients,” says Penney. “If it’s too complicated the resources required to code for us become onerous, so we worked very hard on developing concepts and services that are easy to understand and easy to implement by our clients. We think we have the right level to begin with to get peoples’ attention without putting too much of a burden on them.”

Success?

The big question for 2022, or rather perhaps for 2023, is, will these changes work? The sense is that both firms may have to endure a further dip in activity as the measures are introduced, the critical factor will be how long this dip is sustained. If those market participants who have been pushing for change support the venues through more natural interest and volume, this is likely to be a good news story for CME and LSEG, the two ultimate owners of the platforms. If, however, any dip is sustained, the associated diminishment in the quality of what remains an expensive market data feed will have a serious impact on the businesses and will represent a test of patience for senior managers.

This means 2022 could see a high-stakes game for both EBS Market and Matching unfold. Both venues should be lauded for taking decisions that would inevitably lead to a degree of conflict and some difficult conversations with some clients, but there will, no doubt, be some nerves at both venues as the year unfolds.

What could help the venues bed in their new rules is something that many in the FX industry crave – a sustained period of volatility. Such conditions lend themselves to the no-last look venues like Matching and EBS Market and, if their timing is fortuitous, could provide a volume bounce to coincide with the new programmes being rolled out, thus buying them some time.

One market participant, the head of e-FX at a bank in North America, sees potential opportunity for EBS and Refinitiv’s proactiveness, saying, “Even if volatility is slow coming back to the market it’s likely to arrive at some time in 2022. If the primary venues are prepared, and have their new environments ready, they could get the double bonus of higher quality business in a naturally busier market.”

Ultimately, the sense is the changes will have a positive impact on the two businesses, but there needs to be a sense of proportion to how we judge it. A better environment is likely to ensue from the changes at both platforms, but this does not mean volumes will return to where they were a decade ago – the market structure has changed too much for that to happen. That said, in a year’s time, the debate around the primaries’ viability could also be history.