What Happened at the Month-End Fix?

Posted by Colin Lambert. Last updated: April 4, 2022

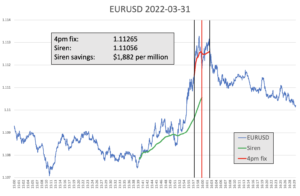

Perhaps not unexpectedly given it was a quarter end – although it has to be pointed out this was not the case with recent quarter ends – the potential savings to investors from a longer 4pm FX fixing window were sizeable on March 31, with EUR/USD in particular seeing huge savings from the Siren 20-minute measurement compared to the WMR five-minute window.

Interestingly, three of the four major currency pairs offered three of the four largest savings, led by EUR/USD at a staggering $1,882 per million, more than double the average monthly saving of $794 per million recording by The Full FX since it started tracking this data. There were also sizeable (above the one-year average) in USD/JPY ($889 per million) and Cable ($950).

The data tables below offer a comparison with data delivered by Raidne, which owns the Siren Fix. The Full FX has independently verified that the WMR data, which is calculated from New Change FX data by Raidne, reasonably reflects the month-end rates delivered by WMR.

To provide more context, the table also presents projected dollars per million savings across a portfolio of different pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”.

| March 31 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 1.11265 | 1.11056 | $1,822 | $1,129 | $753 | $376 |

| USD/JPY | 121.375 | 121.483 | $889 | $533 | $356 | $178 |

| GBP/USD | 1.31665 | 1.3154 | $950 | $570 | $380 | $190 |

| AUD/USD | 0.75095 | 0.75032 | $840 | $504 | $336 | $168 |

| USD/CAD | 1.24905 | 1.24952 | $376 | $226 | $150 | $75 |

| NZD/USD | 0.69555 | 0.69511 | $633 | $380 | $253 | $127 |

| USD/CHF | 0.92025 | 0.02096 | $771 | $463 | $308 | $154 |

| USD/NOK | 8.7440 | 8.75319 | $1,050 | $630 | $420 | $210 |

| USD/SEK | 9.3194 | 9.32429 | $524 | $315 | $210 | $105 |

| Average | $879 | $528 | $352 | $176 |

*According to Raidne calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

As indicated by the chart below, buying accelerated into the WMR window, with EUR/USD jumping some 20 points in the last three minutes before the window opened. Window activity was characterised by more buying at the start, a mid-window dip, probably as some speculators saw the chance of profit at the 1.1130, compared to the 1.1115 seen as the shorter window opened. Immediately the WMR window closed, EUR/USD sold off to the 1.1110 area, where it hovered before drifting lower again at 1.1100.

In contrast, the run up to the 20-minute Siren window was characterised by sideways trading, even a drift lower. It should be noted that EUR/USD busy at that time – the one-hour range from 3.10 UK time to 4.10pm was 1.1070 to 1.1134.

Every month The Full FX is selecting an emerging market currency pair at random, and before the data is available, to broaden the analysis – this month the selected pair is USD/RON. Data is again provided by Raidne according to the same guidelines in place for the regularly reported currency pairs.

As was the case with the G10 and Scandi pairs, there was steady dollar selling interest, resulting in the Romanian leu dropping sharply into the WMR Fix, exiting the window at the lows, and then recovering steadily – pretty much to the levels it entered.

The resulting $2,143 per million potential savings for investors – the third highest saving recorded by The Full FX for one of its selected emerging market pairs.